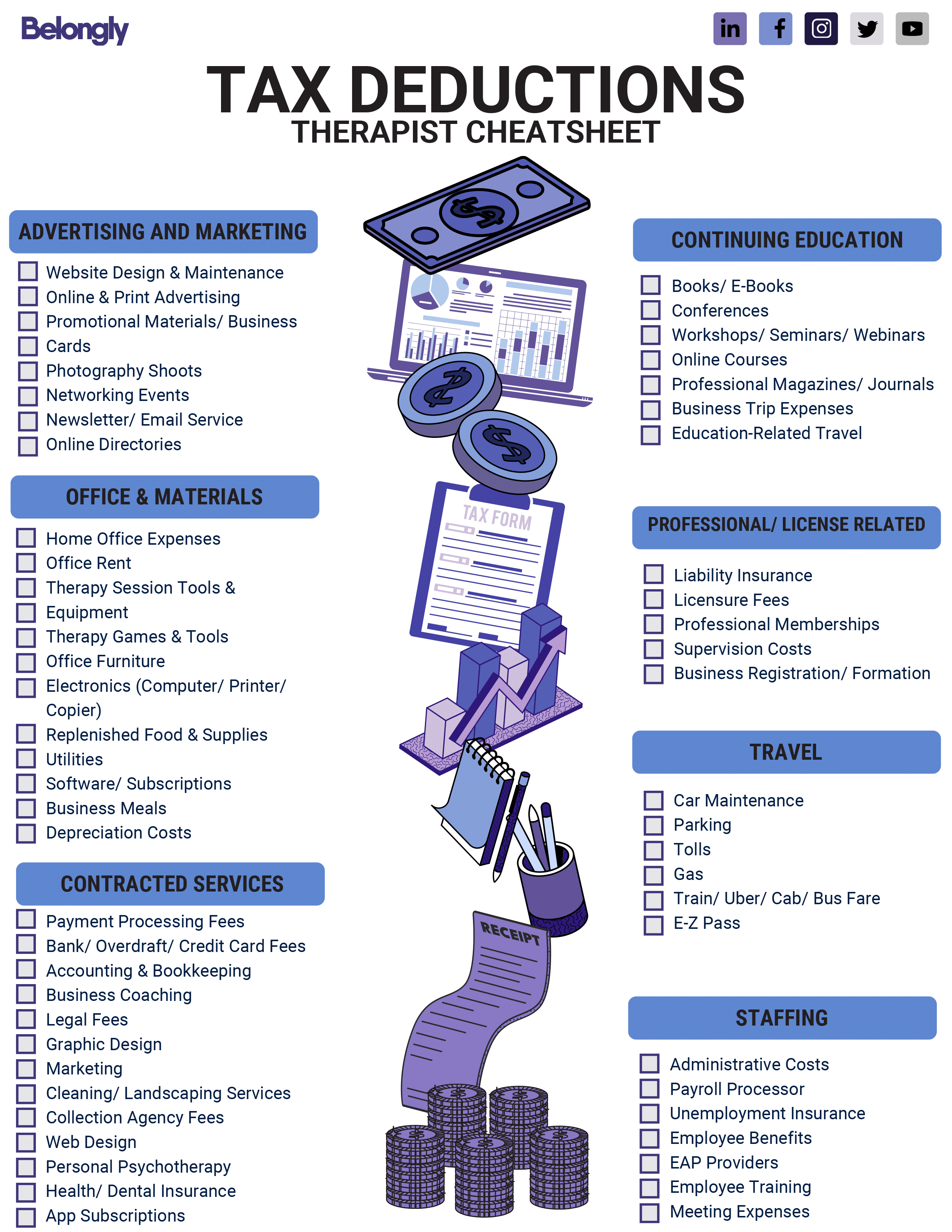

The Tax Deductions Cheatsheet For Therapists

To ensure that all potential tax deductions are accounted for, it is recommended that you thoroughly review all business expenses and start tracking and retaining receipts. Use this tool as a start, keep a binder, folder, or other storage tools, and stop dreading tax time when it rolls around!

The Tax Deductions Cheatsheet For Therapists

To ensure that all potential tax deductions are accounted for, it is recommended that you thoroughly review all business expenses and start tracking and retaining receipts. Use this tool as a start, keep a binder, folder, or other storage tools, and stop dreading tax time when it rolls around!

Just in time for taxes, we put together a handy checklist to track your deductions for the year- reusable for next year too! It’s so important for self-employed therapists, whether in private practice or contracted through an agency, to keep track of expenses that will save you money.

Being a great therapist is expensive! However, failing to recognize eligible deductions could result in missed opportunities. Organization of what’s deductible and keeping receipts can be such a headache! To ensure that all potential tax deductions are accounted for, it is recommended that you thoroughly review all business expenses and start tracking and retaining receipts. Use this tool as a start, keep a binder, folder, or other storage tools, and finally, stop dreading tax time when it rolls around!