Money is often a fraught issue, particularly for therapists. We specialize in talking about difficult subjects, but somehow, the subject of money is still taboo. It’s as if we think that earning a decent living runs counter to our values as mental health practitioners!

However, if you want to keep helping clients, you need a plan for financial sustainability. Here are 10 financial management strategies for your practice.

Separate business and personal accounts

This is a common mistake among money avoiders, who prefer to spend as little time thinking about money as possible. However, keeping business and personal accounts separate simplifies bookkeeping and accounting and helps to maintain a professional image. In addition, separating personal and business finances can help you avoid errors in tracking and taxation, effectively circumventing legal and financial issues down the line.

Use a bookkeeping system

A bookkeeping system allows you to successfully monitor the financial health of your practice. By tracking expenses and income, you can make informed decisions about how much to charge for services and when to invest in marketing or other growth opportunities. A bookkeeping system can also simplify the process of filing taxes, saving you time and money in the long run.

Set realistic fee structures

It can be challenging to balance the desire to help clients with the need to earn a living. Some therapists simply look at what colleagues with equivalent experience are charging and decide, “I’ll just charge that.” However, experts recommend figuring out how much you need to thrive personally and professionally, then working backward to set your rates. (For a free guide to raising your rates, click here.) Setting a realistic fee structure helps to ensure that you are fairly compensated for your services, guarding against resentment and burnout.

Diversify income

Client payments and insurance reimbursements can fluctuate based on seasonal factors, claims delays, illnesses, and emergencies. Diversifying your income will help to mitigate these inconsistencies. There are many ways to make money outside of sessions with clients, including teaching, writing, consulting, and blogging.

Set a budget

We all know budgeting is important, but few of us jump at the chance to crunch numbers. However, a comprehensive budget helps you plan for tax payments and allocate funds for professional growth. It also helps to identify areas where expenses can be reduced. Make sure you include expenses like insurance premiums, licensing fees, membership dues, and continuing education.

Use an EDI for billing

Electronic Data Interchange (EDI) systems allow therapists to send claims electronically, saving time and reducing the risk of errors. EDI systems automatically identify any issues that need to be addressed, allowing you to resolve problems quickly and efficiently and helping you to avoid missed payments or delayed reimbursements. Moreover, some EDIs integrate with practice management systems like Theranest and Simple Practice.

Offer online payment options to your clients

Online payment systems offer a convenient and secure way for clients to pay their bills. By offering online payment options, you can reduce delays associated with traditional payment methods like checks or cash. In addition, many systems allow clients to set up auto-payment, helping you avoid the hassle of chasing clients down for copays and other fees.

Network

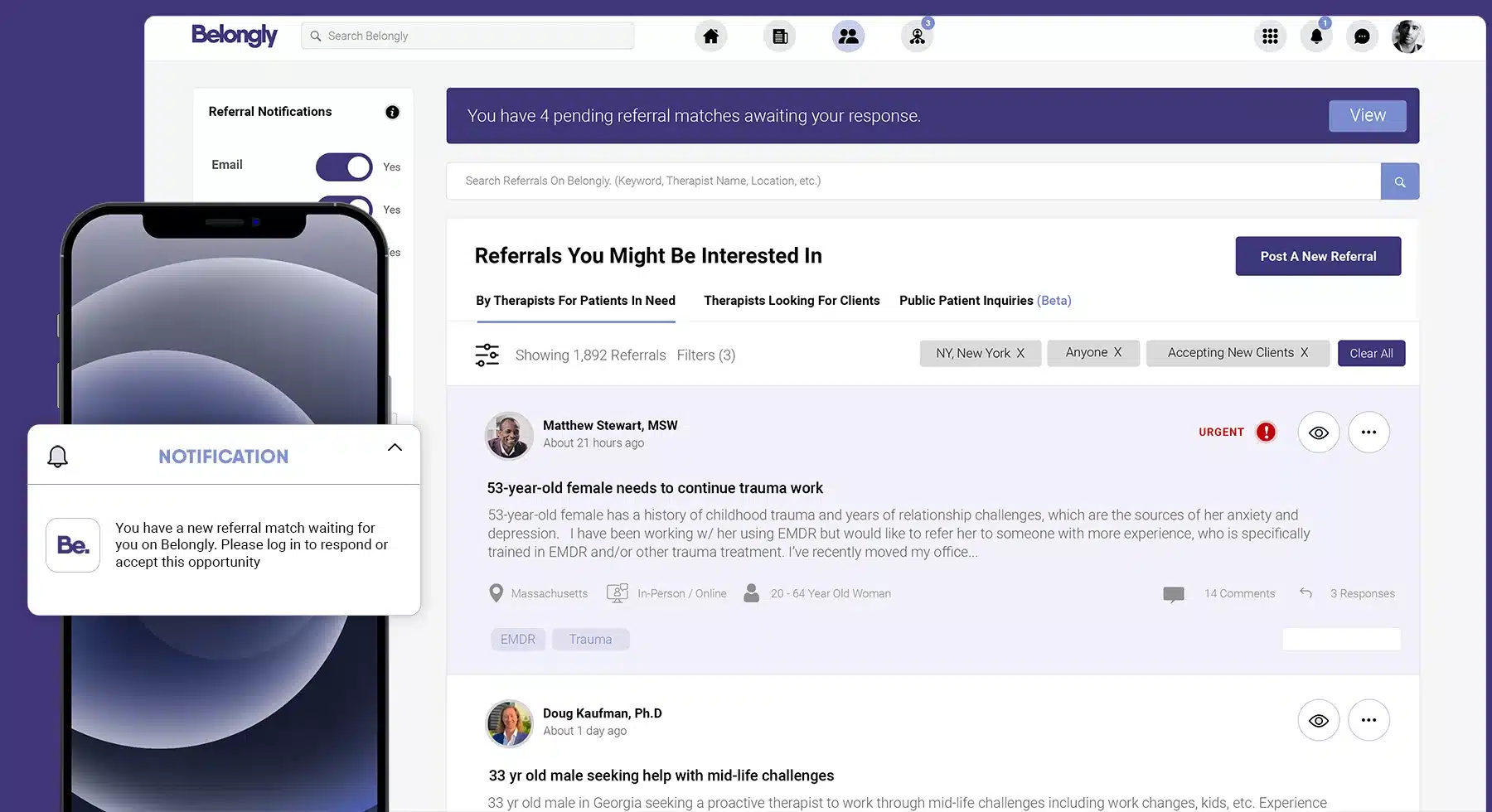

Networking with other mental health professionals can generate referrals, helping you to maintain a steady stream of clients. Belongly makes networking easy with its HIPAA-compliant platform designed specifically for therapists. You can use Belongly to send and receive referrals, access practice resources, connect with peers, and discover opportunities for growth and development.

Establish an emergency fund

An emergency fund provides a safety net in case of unexpected events such as illness, injury, or a sudden reduction in clients. This money can help to cover expenses like rent, utilities, and other bills. Having an emergency fund also means that you can take time off from work to care for yourself or your loved ones without having to worry about finances. Otherwise, you may be forced to dip into your savings or rely on credit cards, which can lead to financial stress and strain.

Make sure you have proper liability insurance

No therapist enjoys thinking about potential lawsuits, but unfortunately, it is an occupational reality. Liability insurance protects you against legal claims and helps to safeguard your reputation and financial stability. A liability policy can help to cover legal costs, settlements, and judgments in the case of a malpractice claim. Instead of worrying about potential financial and legal consequences, you can focus on providing quality care to your clients.

Keep Reading

Want more? Here are some other blog posts you might be interested in.