Relationships can compare a lot to financial investments. Both have to be taken care of in different ways in order to keep yourself content, and require attention, focus, and time.

Often, people are picky with their financial investments, which can be a good thing. They do tons of research, read books, + pay very close attention to the market but these same individuals have a tendency to neglect even acknowledging their own emotional spending habits.

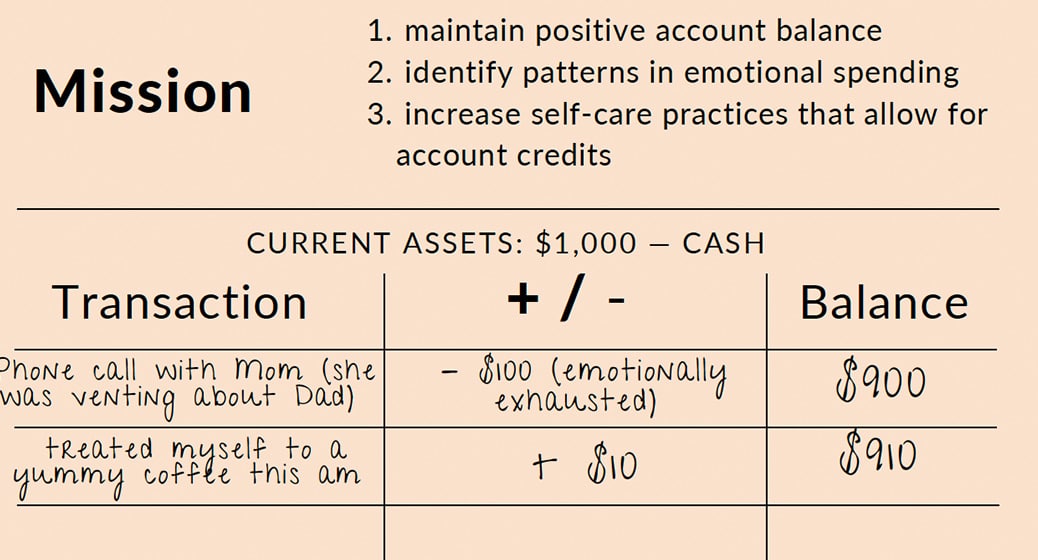

The financial world can seem like its own universe. It is a place full of numbers, spreadsheets + it even comes with its own lingo. While some may find this intimidating and choose to distance themselves from financial investing, emotional investments are essential considerations for everyone, even those who avoid investments like the plague. Just like balancing a checkbook (if anyone even does that anymore) it can be helpful to keep track of not only emotional expenses but earnings too.

There is an old saying that ‘a good relationship is a two-way street,’ but who is responsible for making sure the traffic is evenly flowing in both directions? There are so many different types of relationships: significant others, family, friendships, work relationships, neighbors, + more that it can easily cause a traffic jam. Now, for a moment think about each of those relationships. They each bring joy, happiness, companionship, maybe drama, stress, + headaches too. Each relationship comes with its own rewards and expenses. Exhausted yet?

Assume that each interaction with another person has an associated value (earned, or spent). Coffee with a coworker might earn $5: it is a brief interaction that might feel good, it is enjoyable. A friend might call with relationship drama: while friends are great to lean on for support, the conversation might be taxing & that might cost $10. A family fun day to the beach can both be a blast and pose some challenges, so in this situation, someone might break even.

Just as one might track their financial investments, it is critical to monitor emotional spending to avoid going bankrupt. Doing this not only allows people to understand the value of each relationship but also creates space for self-care. If someone has a low balance starting off the day, it is even more important for them to make sure that they are making some emotional deposits to avoid an overdraft. Tracking spending + earnings can help reveal patterns + allow for the appropriate changes to be made. It is equally as important to identify positive investments + figure out how to continue to increase one’s emotional net worth. Maybe regular exercise deposits enough into the account, or perhaps a weekend away brings in just enough capital.

If nothing else, it can be helpful to start an emotional budget to look for patterns in emotional spending and withdrawals. Having a better understanding of emotional spending and earning habits can allow for a wiser allocation for these emotional investments.

Keep Reading

Want more? Here are some other blog posts you might be interested in.